NEWS ARCHIVE - MAY 2011

For current news items, go to the home page

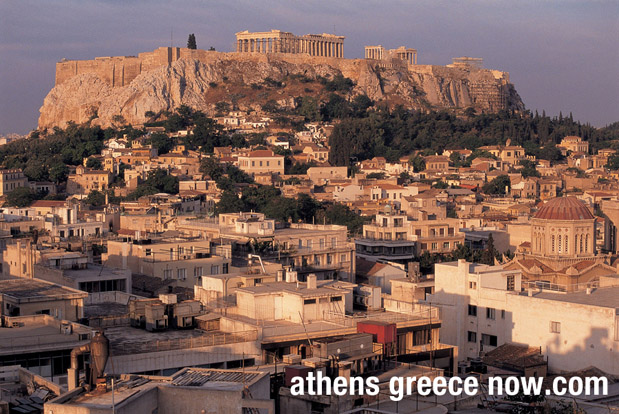

The Acropolis in Athens, Greece. Source: Big Stock Photo

May 27, 2011

G8: "Greece must do more" "May not see latest bailout payment"

Writer Leigh Phillips at the EU Observer has a breakdown of the points made by the G8 leaders concerning the Greek financial crisis:

"... the leaders of the G8 countries put the Greek situation and the eurozone crisis under the microscope, according to the Japanese delegation, worried that the ongoing problems in Europe are hitting the world's economic recovery.

...Speaking to reporters at the meeting, EU Council President Herman van Rompuy said that Europe would "not let the euro fall".

"Regarding a possible restructuring of the Greek debt, we will do our utmost not to face a default, not to face a credit event," he said. "We will do everything we can to maintain financial stability of Eurozone."

"We trust Greece will take all necessary measures and all necessary reforms to reach the fiscal goals that have been decided upon," he continued.

...Without Washington's support, the IMF could not involve itself in a second rescue of Greece, a position that may be in doubt.

Already on Thursday, the chair of the eurogroup of nations, Jean-Claude Juncker, hinted that Greece may not see delivery of its latest tranche of bail-out cash if the latest review by inspectors of its budgeting does not deliver a passing grade."

The "Group of Eight" consists of: France, Germany, Italy, Japan, the United Kingdom,United States and Russia.

Pressures between IMF/eurozone demands (with threat of no more money) and Greek demands (and threat of default) has become a bluff game to see who is more serious.

This report by Niki Kitsantonis at the New York Times reflects the tensions:

"Prime Minister George Papandreou failed to find common ground with opposition leaders in individual meetings on Tuesday, and is hoping that the joint session, convened by President Karolos Papoulias, might achieve some kind of cross-party agreement on measures that are sure to be unpopular.

The aim is to convince officials of the European Union and International Monetary Fund that Greece has the political will to impose more tax hikes and spending cuts on a Greek public already weary after a year of belt-tightening.

...This week the Greek media has been dominated by speculation about snap elections or the possibility of a return to the drachma. The European Marine Affairs Commissioner Maria Damanaki, who is a Greek Socialist, added fuel to the fire when she suggested on Wednesday that talks are already taking place about Greece’s possible exit from the euro zone.

“The scenario of Greece distancing itself from the euro is on the table. We either agree with our creditors on a program of tough sacrifices that brings results, and assume the responsibilities for our past, or we return to the drachma,” she said. "

May 26, 2011

"Skeptics are saying that Greece, facing loans of more than 150 percent of gross domestic product, will eventually have to restructure its debt — paying back less than face value."

The New York Times assembled a group of seven experts to discuss the Greek financial future. The participants on the "Is there any hope for Greece?" panel were:

- The Euro Zone's Structural Problem by Simon Johnson

- Dump the Euro by Desmond Lachman

- Beyond Austerity Plans by Barry Eichengreen

- It's About Political Will by Edward Harrison

- How Banks Fueled the Crisis by Anat R. Admati

- Expect More Bailouts by Veronique de Rugy

- It Could Have Been Worse by Vanessa Rossi

As an example, here's what De Rugy said:

"The Greek debt crisis didn’t materialize overnight. It is the product of decades of mismanagement of the country’s finances, overspending, unrealistic promises to every possible interest group and an unwillingness to address issues before it was too late. Now Greece has to act to try to prevent being crushed by its mounting debt. What should Greece do?

Short of declaring bankruptcy, Greece should cut its spending and reform its entitlement programs.

In the 1980s, Ireland successfully restructured its debt by, among other things, devaluating its currency. This remedy is now being tossed about for Greece, but there are crucial differences.

First, even if Greece exited the euro zone, the Greek debt (public and private alike) would remain in euros. As the George Mason economist Garett Jones explains: “This was tried before in Asia in 1997. Devaluation when you owe money in a hard currency creates as many problems as it solves.”

Second, while there is little doubt that a weaker currency than the euro would be more appropriate for a relatively poor country like Greece, richer nations in Europe, like Germany, won’t accept such a move. They fear a bank run on other weakened countries like Portugal and Spain would follow. As a result, there are likely more bailouts in Greece’s future rather than a devaluation. The question, of course, is how long will the German people be willing to pay for the fiscally irresponsible behaviors of their neighbors.

Short of declaring bankruptcy, Greece should cut its spending and mainly reform its entitlement programs."

May 24, 2011

"International creditors ...will ultimately decide whether Greece becomes the first country in euro zone history to go bankrupt" - WSJ

An interesting consideration in this Wall Street Journal report by Alkman Granitsasis that a 'snap' election would result in a hung Greek parliament, split so evenly on what to do about the crisis that nothing could get decided or done, and the infighting going on now would only be amplified into complete paralysis. And then the article describes the current situation as Papandreou's government tries to shoulder both the demands of the various creditors pressuring Greece and also the Greek citizen demands, too: that description looks a lot like near paralysis already. With a slight majority hold in parliament, Papandreou can hammer through some of the demands he needs to convince Greece to accept (for example, more taxes and privatization), but all of this will surely lead to even bigger public protests, shut-downs and strikes.

"But by all accounts, the government is more deeply divided than ever over those new measures with at least one cabinet member suggesting that the government is close to exhausting its popular mandate. There are worries that when the measures go to parliament, not all of the Socialist deputies will show up to vote. The opposition New Democracy party, in a statement Tuesday, flatly rejected the latest government measures.

Once again, there are rumblings of early elections in the offing.

That would be an unmitigated disaster. According to most public opinion polls, elections now would lead to a hung parliament with neither of the two major parties—the Socialists or the center-right New Democracy party—able to form a majority government."

The difference between that possible result and the present conditions seems to be narrowing by the day.

Referendum on austerity plan coming?

News about Papandreou's proposed referendum vote here, May 2011

Boston Globe: "Consensus on debt plan eludes Greece"

Opposition among the political groups in Athens preventing any solidarity on following austerity plan requirements (which seems to emphasize all major political parties must support the IMF/eurozone authored restructuring plan):

"...Greece, which is struggling to meet the terms of a $154 billion bailout and could require more help, needs all of its political parties to back the debt-cutting plans to ensure they can be implemented. They have not said outright that receiving the next installment of the bailout, due in June, depends on such agreement, but they have stressed the importance of opposition support.

...Antonis Samaras, head of the main opposition conservative party, earlier this month called for a renegotiation of the bailout deal. He argued the government’s overall direction in dealing with the crisis was wrong.

Samaras has in the past backed certain measures, such as privatizations, but said ever-increasing taxes serve only to push the country deeper into recession. He underlined his party’s proposal for reducing taxes to jump-start the economy.

“The government lacks the courage to restart the economy and is not considering a renegotiation. It is repeating the same mistake, and exceeding the limits of the Greek economy and of our people,’’ Samaras said."

Quote above via the USA Boston Globe.

Taxation seems to be a critical crossroads, since it is the implementing factor most likely to raise the revenue the IMF plan requires to succeed, but opposition experts claim it is the principal source of the pall cast over the Greek economy. Differences in economic philosophy is just the starting point of the fight over taxation, it is also an overlapping factor into most other spheres, because the taxation system has been radically overhauled to remove the last vestiges of Ottoman-style methods.

Lament for the Greek stereotype

Article by Nick Malkoutzis at eKathimerini about the ongoing evolution of the Greek stereotype in Europe, particularly with the Germans:

"Greeks who work hard, who spend wisely, who abide by the law and who pay their taxes -- yes, such people do exist -- have had to endure months of generalizations and stereotyping. They have had to develop thick skins as a growing number of comments indiscriminately refer to all Greeks as feckless, lazy and corrupt. In some cases these epithets are deserved, but in many cases they are a complete distortion of reality, bordering on racism.

The image of the undisciplined Greek loafer who fritters away the day doing nothing is proving useful for a number of European politicians, not just Merkel, but it is difficult to criticize them when the government in Athens is doing nothing to combat this image. If anything, it is allowing it to be cultivated -- perhaps because Greece’s politicians feel that this way they have an alibi when they are unable to meet the targets set by the EU and the IMF. It is easier to blame economic and political shortcomings on social inadequacies or cultural traits rather than accept your own failure.

If the last year has taught us anything, it is that millions of Greeks, who want to be part of a modern, efficient country and a progressive EU, are trapped. "

View of the Odeon of Herodes Atticus amphitheater on the southern slop of the Acropolis View Enlargement

May 12, 2011

Inflation in Greece - May 2011 Chart and Statistics via ElstatWages falling in Greece at up to 15% in 2011

Enet.gr has a breakdown of wage erosion in Greece under the debt crisis and IMF/eurozone austerity arrangements. For example, an incredible wage drop of nearly 35% is estimated for hotel wokers within the article, along with a declaration of a 15.7% unemployment rate overall.

"In real terms (i.e., taking into account inflation), the average gross wage in the whole economy fell by 9.3% in 2010 (against an increase of 3.3% in 2009) and is expected to further reduce by 5% - 5.8% in 2011. Overall, that is, over 15%.

The average gross nominal earnings in 2010 decreased by 2.9% in non-bank private sector (compared with an increase of 2.8% in 2009), by 1.8% on banks (compared with an increase of 3.7% in 2009) and 5.5% in utilities (7.7% increase over 2009). In 2011 a further reduction of 1.7% in the non-bank private sector banks 3.3% and 6.2% in utilities. "

Drachma = Suicide

Writer Alexis Papachelas at Kathimerini:

"A country can’t just sit by doing nothing except reaching out to Europe every year or so for help, using its own bankruptcy as a lever.

On the other hand, we could always listen to those insane, dangerous and already bankrupt businesses that want Greece to return to the “good old drachma,” in which case we will become the first country in the world to opt for a spectacular suicide when everyone else was trying to save it."

May 11, 2011

General Strike underway across countryMay 9, 2011

"Technical Default" up ahead Standard and Poor's downgrade Greece further

New eurozone idea: Demand for Collateral

May 6, 2011

Is Greece planning a new drachma and an exit from the EU? "Dire consequences if Athens were to drop the euro"May 5, 2011

Civil servant work week going to full 40-hours

May 1, 2011

Sovereign default predictions again on the rise

Greece's Golden Visa program